This week the Ontario government will be busy telling the Ontario electorate how much they can save on their auto insurance by installing winter tires - what they will not be telling you about is what will happen to you if you get in accident while driving along on your cost saving winter tires.

The 2015 Ontario budget introduced this week contains measures that will further strip away at the benefits available to accident victims. There are proposed changes to both the accident benefits and the tort system.

In 2010 Ontario accident victims saw a drastic reduction to the benefits available under their insurance policies. The cuts have continued this time around. The cuts are deep and they put vulnerable accident victims at considerable risk.

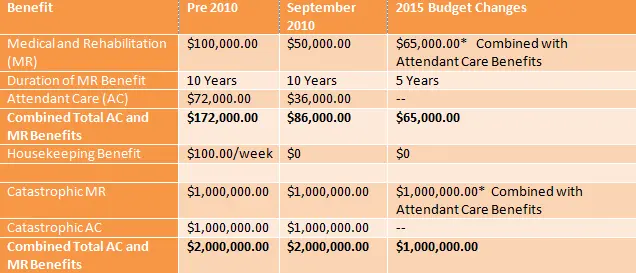

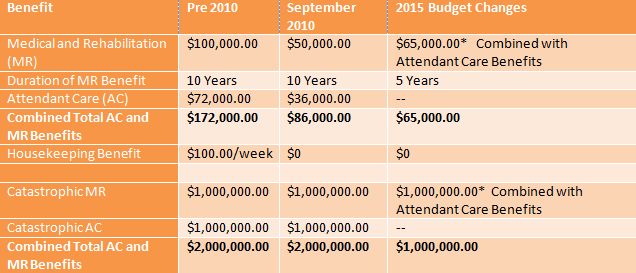

In just five short years, accident victims have lost a significant amount of benefits as outlined in the chart below:

Other changes to the Accident Benefits and Tort System Include:

• Elimination of Non Earner Benefit waiting period - but these benefits cease at 2 years

• There will be changes to the definition of Catastrophic Impairment

• Tort Changes - the deductible (currently $30,000.00) on general damages claims will be increased to meet inflation and the threshold for elimination of the deductible (currently $100,000.00) will also be increased to coincide with inflation

While budget cut backs to government programs may be justified, necessary and tolerated at times, it must be noted that these particular cut backs do nothing to improve the government's bottom line, they do nothing to benefit the individual taxpayers of Ontario - they do however, benefit private insurance companies; private insurance companies who make significant profits on the backs of Ontarians who are forced to buy their products.

This blog post was written by Gluckstein Personal Injury Lawyer Angela Comella.

Share

Subscribe to our Newsletter