Did you know that car accident victims have their general damages claim damages reduced by a statutory deductible? They do - and it's about to get worse.

For years, accident victims in Ontario have had their general damages claims reduced by a statutory deductible.

How does this deductible work and what does it mean?

Let's consider two scenarios:

Scenario A

Imagine for example that you slip and fall on a sidewalk, you break your arm and you decide to sue for pain and suffering damages. Imagine further that your pain and suffering damages are assessed as being worth $45,000.00. In this case you would receive damages in the amount of $45,000.00.

Scenario B

Let's look at a different scenario, imagine that it is before August 2015, and that you are in a car accident you break your arm and you decide to sue for pain and suffering damages. Imagine further that your pain and suffering damages are assessed as being worth $45,000.00. In this case you would only receive $15,000.00.

Same injuries, dramatically different compensation

The only difference between scenarios A and B is the fact that one is a slip and fall and the other is a car accident. The injuries are exactly the same but the compensation is dramatically different.

The same type of deductible is applied to the Family Law Act Claims of the family members of car accident victims.

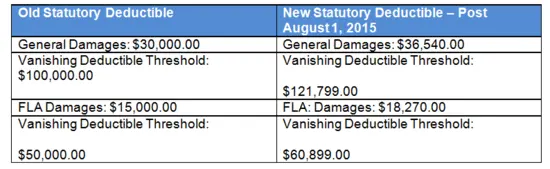

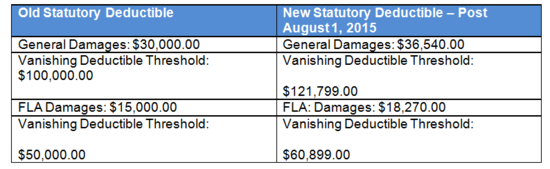

There are benchmarks or thresholds when the statutory deductible does not apply, for General Damages it was $100,000.00 and for Family Law Act claims it was $50,000.00.*

*The deductible does not apply to FLA Claims in cases involving a fatality.

Unfair system

Most people would agree that this is not fair, and it's about to get worse. The Ontario government has introduced changes to Ont. Reg. 461/96 which increases both the statutory deductibles and the threshold at which the deductible does not apply. The amendments to the regulation came into force on August 1, 2015. The government intends to increase both these amounts on annual basis to account for inflation.

The changes are outlined in the chart below:

These changes certainly benefit private auto insurers in reducing the amount of claims money they need to pay to innocent accident victims.

Tougher for Ontario injury victims

On the whole, these changes are disappointing. While these changes are implemented by the provincial government it must be remembered that they do not benefit the government or the people of Ontario generally and they certainly do not do any favours to accident victims who struggle to rebuild their lives after an accident and are now forced to do so with much less compensation.

LINKS:

- https://www.gluckstein.com/team

- https://www.gluckstein.com/news-item/the-2015-canadian-legal-lexpert-directory

- https://www.gluckstein.com/news-item/are-changes-to-the-cat-definition-catastrophic

Written by Angela Comella, Lawyer, Gluckstein Personal Injury Lawyers

Expertise.

Share

Subscribe to our Newsletter